Jeff Glenellis – How to Day Trade Crude Oil Futures

$74.00

Instant Download: You will receive a download link via your order email immediately

Should you have any questions, please contact us: [email protected]

But an entire industry has sprung up, dedicated to (allegedly) making you a better trader by teaching you everything you never needed to know about trading and all the component parts.

Indicators (there are hundreds of them), charting software and all the options that go with it, trading time frames, the mental and emotional games related to trading, the impact of astrology (star signs) on trading (and no, I’m not making that last one up)…

And all of this information can be yours if you just sign up for a course that costs $599, $997, $4,999, etc.

I know of traders who have spent upwards of $15,000 in their quest to become better traders and still can’t show two winning weeks in a row. And I have no doubt there are people out there who spent more than that.

Look, it’s not about how much you know about trading. In fact, knowing too much can lead to what experts call “paralysis by analysis” which means you know so much and can see things from so many different angles and perspectives, you can’t make a decision to buy or sell due to all the conflicting bits of information you are processing.

The Good News Is I Can Help You “Fix” These Problems and Turn You Into a Consistent Winning Trader In Less Than an Hour

If you are serious about becoming a winning day trader, then your first step is to forget everything you know, or think you know, about trading, and simply start over.

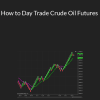

Pick a vehicle to trade (ES, MES, CL, or whatever), set up a single chart and add 2 indicators…one for trend and one for entries/exits. Only enter a trade in the direction of the trend and exit when the entry/exit indicator tells you.

Can trading possibly be any simpler than that?

And don’t worry, I can hear your questions and comments from here.

- What about using “Indicator X” and/or “Indicator Y” and/or “Indicator Z” for confirmation?

- What about confirming the trend on higher time frame charts?

- Don’t I need to use a big stop loss and risk too much of my account on a single trade?

- (And my all-time favorite): If it was this simple, wouldn’t everyone already be trading like this?

5 reviews for Jeff Glenellis – How to Day Trade Crude Oil Futures

There are no reviews yet.